Favorable Phrases and Fees: SBA loans often provide longer repayment terms and reduced curiosity costs than classic loans, producing month to month payments far more manageable For brand spanking new business owners.

Small business proprietors might take pleasure in decrease APRs in comparison to other small business financing options. You will typically see premiums of 8-twenty five%, although reduced fees can be found to effectively competent borrowers.

So how exactly does LendingTree Get Paid? LendingTree is compensated by businesses on This great site and this compensation might influence how and where presents show up on this site (such as the buy). LendingTree doesn't include all lenders, personal savings products, or loan possibilities out there within the Market.

Although banking companies and credit history unions generally offer you small-business equipment loans with the most favorable desire charges and terms, they even have demanding eligibility requirements. To qualify for equipment financing from the bank, you’ll usually want solid individual credit rating, quite a few decades in business and excellent financials.

Equipment. If the business demands special equipment, new equipment is more expensive upfront but can bolster your bottom line with lessened Power expenses, a lot less upkeep plus much more prospects through the door.

Bankrate.com can be an impartial, advertising-supported publisher and comparison services. We're compensated in exchange for placement of sponsored services and products, or by you clicking on selected one-way links posted on our web-site. Thus, this compensation might impact how to get a loan for a restaurant how, exactly where and in what purchase goods show up within listing groups, besides in which prohibited by legislation for our mortgage loan, residence fairness and various dwelling lending products.

Overview: SBA seven(a) loans are available as much as $5 million and give repayment phrases around 10 years for equipment purchases. These loans give extensive repayment conditions and very low interest costs, producing them an excellent choice for large-ticket buys, like equipment or machinery.

Present Business Overall performance: For anyone who is purchasing an existing laundromat, provide the business's monetary records to demonstrate its profitability and possible for ongoing achievement.

We help it become less complicated to have the suitable equipment financing on your business. Comprehensive 1 uncomplicated software — with no effect towards your credit rating rating and no obligation — to determine which loan possibilities you qualify for.

Lots of or the entire products and solutions showcased here are from our associates who compensate us. This might affect which merchandise we compose about and exactly where And just how the merchandise appears around the web page. Even so, this does not affect our evaluations. Our thoughts are our very own.

If you believe equipment financing is the proper selection for you, follow these measures to determine whether or not you qualify and to prepare for your personal application.

NerdWallet's written content is actuality-checked for accuracy, timeliness and relevance. It undergoes a radical review system involving writers and editors to make certain the information is as distinct and full as feasible.

Rather than obtaining equipment at a reduction by spending cash when it’s on sale, you’ll fork out a lot more once you increase in the expense of financing.

Now you know what a business loan is and who will get pleasure from 1, Permit’s mention how to truly receive a business loan on your laundromat.

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Seth Green Then & Now!

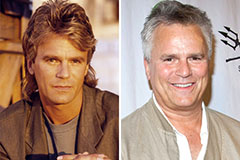

Seth Green Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!